Our Advanced Excel Training Course is tailored for professionals who want to master Excel’s powerful features, particularly in the context of Income Tax and GST. This course covers advanced functions, data analysis, pivot tables, and automation techniques using macros, all of which are essential for financial modeling, tax calculations, and GST reporting. Participants will learn how to create complex spreadsheets for tax planning, generate GST reports, and analyze financial data efficiently. Ideal for accountants, tax professionals, and anyone who wants to leverage Excel for comprehensive financial management.

Our TDS E-Filing Training Course is designed to provide thorough knowledge and practical skills in managing Tax Deducted at Source (TDS) compliance. This course covers all aspects of TDS, including payment, deduction, entry processes, and the e-filing of returns for both salary and non-salary deductions. Participants will learn how to accurately calculate TDS, generate payment challans, and file returns using online platforms. Ideal for accountants, HR professionals, and business owners, this course ensures you can efficiently handle TDS responsibilities and stay compliant with tax regulations.

Our Income Tax Training Course is designed to provide comprehensive knowledge of income tax laws and filing procedures. This course covers key topics such as understanding tax slabs, deductions, exemptions, filing income tax returns, and using online tax filing portals. Participants will gain practical skills in tax planning and compliance, enabling them to efficiently manage personal and business income taxes. Ideal for individuals, accountants, and financial professionals, this course will equip you with the expertise to navigate the complexities of income tax with confidence.

Our GST Training Course on the GST Portal is designed to provide in-depth knowledge and practical skills for managing GST compliance online. This course covers all aspects of using the GST Portal, including GST registration, filing returns, generating invoices, and managing payments. Participants will learn how to navigate the portal efficiently, ensuring accurate and timely compliance with GST regulations. Ideal for accountants, business owners, and tax professionals, this course will help you become proficient in handling all GST-related tasks through the official portal.

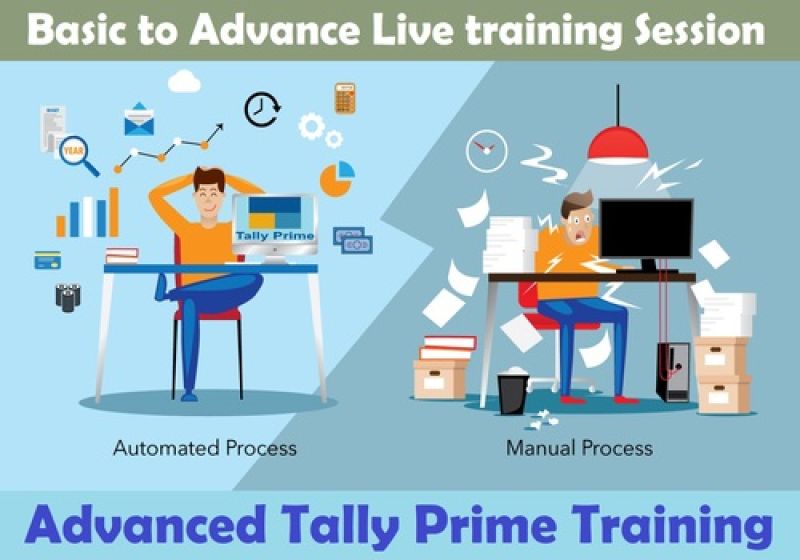

Our Tally Training Course is designed to equip you with the skills needed to efficiently manage accounting tasks using Tally, one of the most widely used accounting software in the industry. The course covers everything from basic accounting principles to advanced features like inventory management, GST compliance, payroll processing, and financial reporting. Ideal for accounting professionals, business owners, and anyone looking to enhance their financial management skills, this course will help you master Tally and streamline your accounting processes.

Our Basic Computer Course is designed for beginners who want to develop essential computer skills. The course covers fundamental topics such as understanding computer hardware and software, navigating the operating system, using word processing and spreadsheet software, browsing the internet safely, and managing emails. This course is perfect for those looking to build a strong foundation in computer literacy, whether for personal use or to enhance their career prospects. No prior experience is required, making it accessible to everyone.